The cannabis infused product category is fundamentally reshaping the industry. Infused pre-rolls generated more than $1.1 billion in sales revenue through the first 10 months of 2025, representing 48.5% of all pre-roll sales and up 14% year-over-year. In Canada, pre-rolls have already overtaken flower as the top-selling category, with infused formats driving that shift.

For cannabis processors, 2026 will be defined by brands that anticipated these trends and built production capacity in 2025.

Infused Pre-Roll Dominance: The 50% Threshold

The infused pre-roll market has reached an inflection point. By 2026, infused pre-rolls are expected to account for over 50% of the pre-roll market, a remarkable shift that reflects fundamental changes in consumer preferences and production economics.

More than $4.1 billion in pre-roll sales were completed in the past year, with over 394 million units sold. Within that massive market, infused formats continue gaining share at the expense of traditional flower-only joints. Infused pre-rolls now make up 38% of units sold, up 28% year-over-year.

The economics explain why this trend won't reverse. Infusion and coatings allow brands to make their flower and distillate go even farther while meeting the market's obsession with potency. By combining less expensive trim or B-grade flower with concentrates, processors create premium products that command higher prices while utilizing inventory that might otherwise be challenging to move.

For operations producing traditional pre-rolls, the competitive threat is real. Consumers consistently rank potency as their top purchasing consideration, and infused products deliver exactly what the market wants. If you're not offering infused options by 2026, you're conceding market share to competitors who are.

Live Resin Infusion: The Premium Product Surge

While distillate-infused products established the infused category, live resin infusion represents the next evolution toward premium offerings. Industry experts expect the infused pre-roll market to continue seeing significant growth, with solventless vapes and edibles also in the aggressive growth category.

Live resin preserves the full terpene profile of fresh-frozen cannabis, delivering the flavor and aroma characteristics that connoisseur consumers seek. As the cannabis market matures, differentiation increasingly happens through quality rather than just potency. Brands that can offer both—high potency through infusion combined with full-spectrum terpene profiles from live resin—position themselves in the premium tier where margins remain healthy even as wholesale prices compress.

The production challenge with live resin infusion is temperature control. Live resin's volatile terpenes degrade rapidly when exposed to heat, making equipment selection critical. Systems capable of infusing at ambient or near-ambient temperatures preserve the terpene profiles that justify premium pricing, while high-temperature processes destroy exactly what makes live resin valuable.

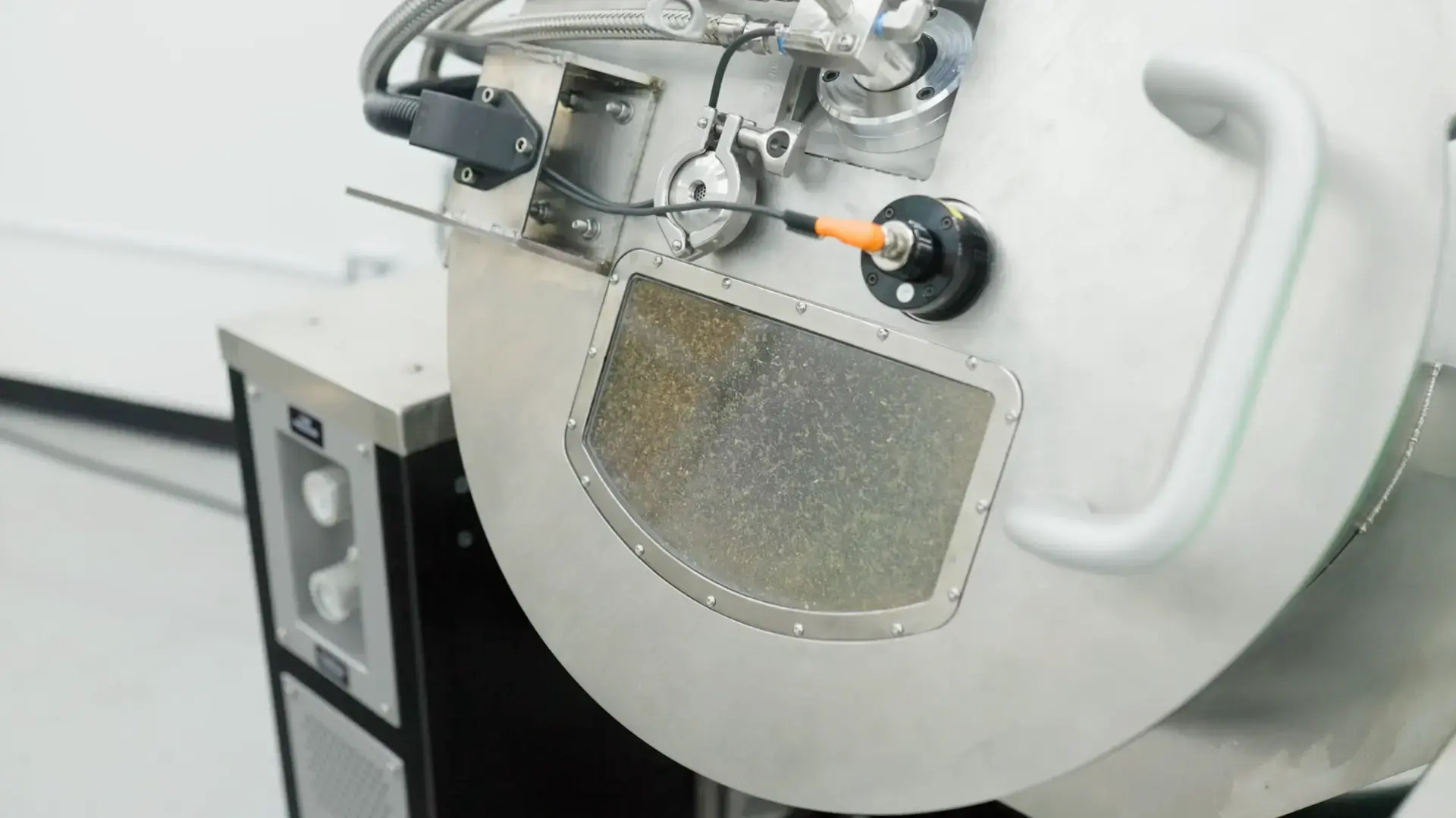

The FX-8 Flower Infusion Machine from Detroit Dispensing Solutions addresses this challenge through precision atomization technology that creates a fine mist of concentrate at controlled temperatures. By infusing up to 8 lbs of flower per 5-minute cycle without excessive heat, the system preserves terpene integrity while delivering the uniform coverage required for consistent product quality.

THCa Diamond Infusion: The Potency Arms Race

In July 2025, Canopy Growth launched Deep Space Infused Pre-Rolls that combine liquid and THCa diamonds to enable THC levels over 60%. This product launch signals where the infused market is heading: extreme potency achieved through diamond infusion.

THCa diamonds—crystalline structures of nearly pure tetrahydrocannabinolic acid—have become the infusion method of choice for brands targeting maximum potency. When crushed and applied to flower, these diamonds create products with THC levels approaching 50% or higher, dramatically exceeding what flower alone can deliver.

The appeal extends beyond just numbers. Diamond-infused joints pack premium THCA hemp flower, burn evenly, and hit harder than standard infused products. The visual impact of diamond-coated flower also creates shelf appeal that helps products stand out in crowded dispensary cases.

For processors, diamond infusion presents production challenges that manual methods struggle to solve. Crushed diamonds are sticky and difficult to apply uniformly by hand, leading to inconsistent potency and wasted expensive concentrate. Automated infusion systems that can handle both liquid concentrates and powdered materials like THCa provide the versatility needed to produce the full range of infused products consumers demand.

The FX-8's flexible dry and wet infusion capabilities handle powdered concentrates like kief and THCa as well as liquid concentrates including distillate and live resin, allowing producers to create diverse product lines without investing in separate equipment for each infusion type.

Strain-Specific Infusions: The Entourage Effect Premium

As cannabis consumers become more sophisticated, they're moving beyond generic "indica" or "sativa" classifications toward understanding strain-specific terpene profiles and effects. This sophistication creates opportunity for processors who can match concentrate sources to flower genetics for enhanced entourage effects.

Strain-specific infusion—using live resin or sauce derived from the same cultivar as the flower being infused—delivers a more pronounced and authentic experience than mixing random concentrates with random flower. This approach appeals to connoisseur consumers willing to pay premium prices for products that respect cannabis as a complex plant medicine rather than just a commodity.

The production challenge is logistics. Maintaining strain-specific concentrates and matching them to corresponding flower requires inventory management, fast changeovers, and equipment that doesn't cross-contaminate between batches. The FX-8's true-batch bag system uses specialty round-bottom drum liners that contain product and prevent cross-contamination, with magnetic rings that enable operators to swap bags quickly between batches without drum cleaning.

Mini & Micro Infused Products: Dosage Control Trend

Microdose products are expected to capture 20% of sales by 2026, representing a significant shift toward controlled-dose formats. This trend manifests in infused products as smaller-format offerings…half-gram joints, petite pre-rolls, and single-serving infused flower products designed for consumers seeking specific effects without overconsumption.

The appeal crosses consumer segments. Medical patients want precise dosing for symptom management. Casual users prefer products that won't overwhelm them. Social consumers appreciate formats they can finish in one sitting without waste. Brands like Dogwalkers are known for their petite pre-rolls, a category that is climbing the ranks along with multipack offerings.

For processors, mini formats require the same production precision as full-size products but at smaller scale, making equipment versatility essential. Systems that can efficiently process both large batches for standard products and smaller batches for specialty items provide operational flexibility as consumer preferences fragment across multiple format preferences.

The Case for Early Investment

The timeline matters more than many processors realize. Equipment that's ordered in early 2025 will be operational by mid-2025, allowing producers to develop SKUs, train operators, and build retailer relationships before 2026's peak demand season. Operations that wait until 2026 to invest face equipment lead times, installation delays, and the steeper learning curve of launching new products under production pressure.

Pre-rolls, especially infused and multi-packs, are the fastest-growing segment in cannabis. The processors capturing market share in 2026 will be those who anticipated demand and built capacity in advance. Equipment investment isn't just about production capability—it's about competitive positioning in a market where being late means conceding shelf space to better-prepared competitors.

Beyond infused pre-rolls, the infusion technology applies across product categories. The FX-8 that infuses flower for pre-rolls also produces infused buds for specialty products like moonrocks and snowcaps, creating multiple revenue streams from a single equipment investment. Processors building infusion capacity today position themselves for whatever product innovations emerge over the next several years.

Equipment Selection: What 2026 Demands

Not all infusion equipment is created equal, and the wrong choice creates production bottlenecks that limit growth regardless of market demand. As you evaluate systems, several capabilities matter for 2026's market requirements:

Temperature Control: Live resin and terpene-rich concentrates require low-temperature infusion to preserve volatile compounds. Systems that rely on heat to maintain flow degrade exactly what makes premium products valuable.

Versatility: THCa diamonds, distillate, live resin, kief—2026's successful brands will offer multiple infused products. Equipment that handles only liquid concentrates limits product development.

Throughput: Multi-packs and infused pre-rolls are winning with consumers who want convenience and consistency. Meeting demand requires production capacity that matches retailer velocity, not just artisanal batch sizes.

Consistency: Consumer expectations for infused products center on uniform potency. Equipment that produces hot spots or uneven coverage creates compliance risk and customer disappointment.

The FX-8 Flower Infusion Machine addresses these requirements through advanced spray mechanism atomization that delivers fine, consistent mist for even coverage; temperature-controlled environments that preserve terpenes; and versatile dry and wet infusion capabilities that accommodate multiple concentrate types. With capacity to process 8 lbs per 5-minute cycle, it provides the throughput needed for commercial-scale production while maintaining the precision required for premium products.

The Bottom Line

For cannabis processors, the strategic choice is binary: invest in infusion capacity now and capture 2026's growth, or watch competitors take market share with products your operation can't produce. The infused product trend isn't reversing. Consumer demand for potency, convenience, and premium experiences continues accelerating.

The processors who thrive in 2026 will be those who recognized the inflection point in 2025 and acted decisively. Equipment investment, operator training, product development, and retailer relationship building all require time. The window for being positioned ahead of demand is now. Contact Detroit Dispensing Solutions to discuss your production goals.

Sources:

- Custom Cones USA: Pre-Roll Trends of 2025

- Flowhub: 2025 Marijuana Industry Statistics

- Accio: Pre Roll Trends 2025

- Velosio: 10 Cannabis Industry Trends Driving Growth

- MG Magazine: Pre-Rolls on Fire

- Markets and Markets: Future of Cannabis Market

- St. Louis Magazine: Cannabis Trends 2026